I have previously written two posts (gamble or game changer and 7 months after) about Jio and talked about what they seem to be getting right and what they aren’t. This post is a continuation of the same.

This time around there are more nays than yays. So, first the issues:

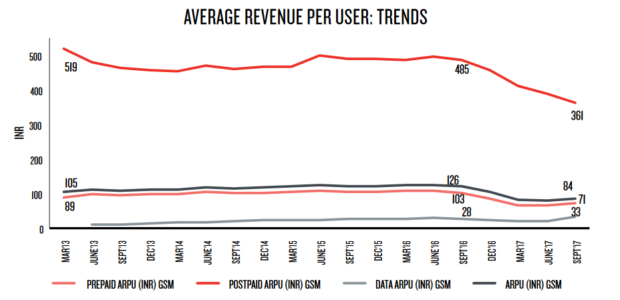

- Neglecting the postpaid subscribers: I started with a postpaid plan from Jio. The reason for choosing it was that on other telecom providers, the postpaid plans offered the best value for money. No processing fee, better data and voice plans, international roaming facilities etc., gave an edge over the prepaid plans there. And I thought the same would apply on Jio. But boy was I wrong! When I moved to Jio, both the postpaid and prepaid plans offered similar value for money. Overtime, the prepaid plans started offering better value. While I paid around Rs.350 for a month for 30 GB of data, for the same amount one could get 105 GB of data for 70 days on a prepaid plan; plus a host of other cashback benefits! Postpaid users who were just 4% of their subscriber base were paying double their ARPU (Rs.154) and were completely being ignored. Even today, if you look at their plans, the cheaper plans offer the best bang for the buck in terms of cost/GB. I fail to understand this stupidity on their part. Anyway, I decided not to be part of the 4% who were improving their ARPU and moved to a Rs.399 prepaid plan thus lowering my cost per month by 62%! Almost 6 months after my switch, they seem to have gone back to the drawing board on the post-paid plans and announced a new offer. In the very second paragraph there, they’ve acknowledged what I’ve written above – “postpaid users… end up paying disproportionately higher as compared to the prepaid segment.”

- Lowering ARPUs: While at one end, the growth rate in subscribers base has been sustained – about 187 million users to date – at the other end is the drop in ARPU. It today stands at Rs.137/user/month from Rs.156/user/month 6 months earlier. This of course, is their own doing. They’ve been cutting sources of higher realisation – bad value for the users in higher priced as well as prepaid plans, waiving off annual prime membership fees for existing subscribers, lowering tariffs by Rs.50 over three months etc. Their strategy seems to be revenue growth from subscriber growth at the expense of ARPU. This is extremely bad strategy because now, competitor pricing actions would probably hurt Jio more than other incumbents. Their own claim that 400

million subscribers can afford to spend Rs 500 and above on digital services is a distant dream now.

- Not allowing free movement between prepaid and postpaid: There is a catch to free movement between these modes of bill payment – when you move between pre to post or vice versa, you are not allowed to carryover anything from the former to later. Which means you lose the money you pay for prime membership as well as any vouchers and offers you might have obtained during previous recharges. This process also cannot happen over the phone or app, you have to visit their stores.

- This brings us to another problem, inconsistent UX and experience – across store, app, IVR and web: Only the self service MyJio app is designed to allow redemption of vouchers, offers and other loyalty benefits. This means that if you use their website, their IVR or if you go to their store to change plans (as in the previous scenario), you don’t get to redeem any coupons or vouchers.

- Restricting Jio Media app usability: I had earlier written that the JioCinema, JioTV OTT apps (that come free with prime membership – which is pretty much for every one) have the potential to cause collateral damage to DTH service providers. But this was short lived, by December 2017 the JioTV app blocked any attempt to view its content on a big screen either via casting and screen mirroring.

- Allowing multiple SIM cards per user: When they started off, they allowed only one SIM per user by giving a unique barcode per device. By their own admission this strategy would reduce voice arbitrage and reduce 1.13 billion SIMs to 0.8 bn SIMs. But last time I checked, they allow any number of SIM cards to be issued to a single user. In their chase of subscriber numbers, they’ve fallen back to ARPU/SIM from their own ARPU/User.

I’ve written about these issues in earlier blog posts as well and they continue to be a problem even after 20 months!

- MyJio app overreach: An app whose primary function should be to allow the user to self manage the account is used to monetise the customer base via advertisements and games! The permissions that the app asks for can allow the app to pretty much snoop on everything you do on the phone. But now, there are other irritants as well – Jio voice assistant draws over other apps, notifications pushed are one too many, full screen ads play every time you open the app. Add to this, the basic reason for installing the app – to check data consumption recorded at Jio – doesn’t work many a times. One is better off not installing this app.

- Jio Network: While they claim to give the, “best network quality in the country” in terms of call drop, speed and availability in their investor presentation, the reality on ground is quite different. My own experience at home, office and airports is that both the speed and network reliability is a huge problem. Plus, I’ve routinely heard people crib about call drops and ability to place calls on Jio network across various states.

- Customer service: Like always a visit to the store or a call to their call center still leaves you bitter. I had to make rounds of 3 different stores to get resolution for a problematic sim card. Particularly aggravating is how they handle DND complaints on spam messages. I would have reported atleast 50 different messages and not once did I get a satisfactory reply.

The one thing that is working in its favor.

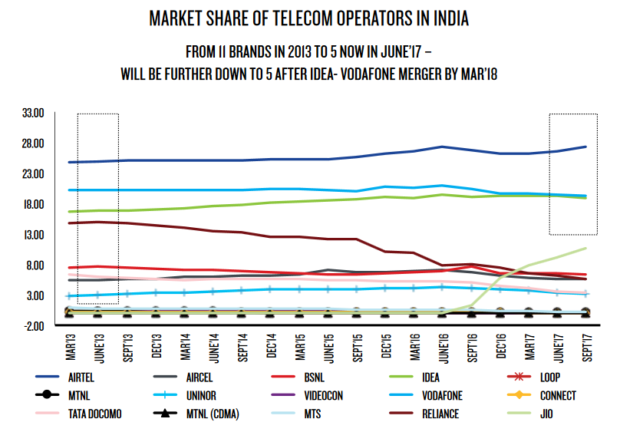

- Subscriber addition: They are seeing a sustained growth in subscriber ever since they launched. From 72 million users in December’16, today they have more than 187 million subscribers and a market share above 10%.

Though I remain unconvinced with their statement of income, especially the profits they show, revenue growth and EBITDA margins should bring cheer to analysts and investors alike.