Following the previous post on emails from financial service firms, here is a look on which brands and what products they are for.

In case, you want the background this series of blog posts is a look at N=240 emails on financial service products that mostly went into my spam folder.

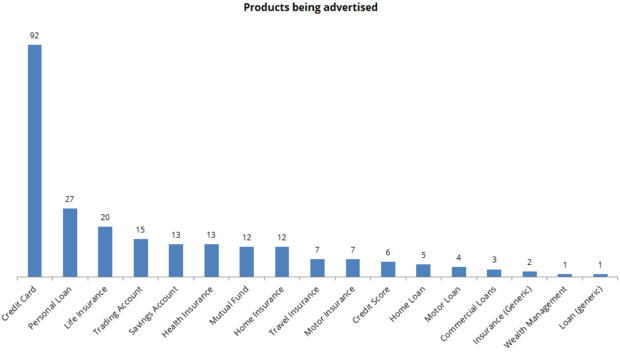

The products:

Credit cards contributed to 38% of all financial services (read spam) emails I received.While credit cards is the most common suspect, I found it surprising to see the quantum of emails on insurance and loans, especially personal loans.Insurance (various) products made up 25% of emails and loans made up 17% of which emails on personal loans alone were 11%.

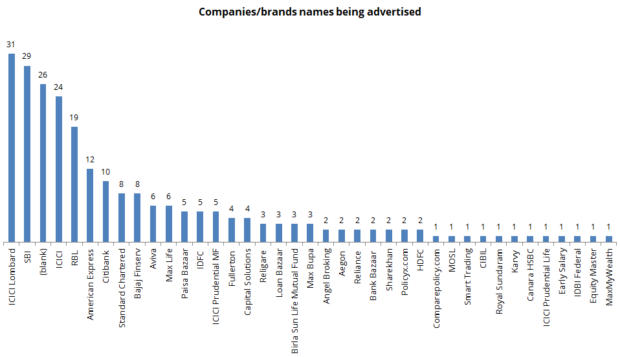

The brands:

I received emails for about 38 different brands/companies operating in the financial services space. Of which, ICICI and its various companies made up 25% of all emails received. Again, while I expected this (I am a customer of most of their products), I didn’t expect SBI to be the #2 brand contributing 12% to all emails that I received. Most of these emails from SBI were about Credit cards particularly a IRCTC tie-up one! The other surprise was RBL which made up 8% of all emails. It was followed by the usual suspects selling credit cards – Amex, Citi and StanC (peddled personal loan and credit card in equal measure).

Then there were a lot of emails that I couldn’t really locate the brand for? These are what show up as (blank) in the chart above (a few of these examples in a later blog post).

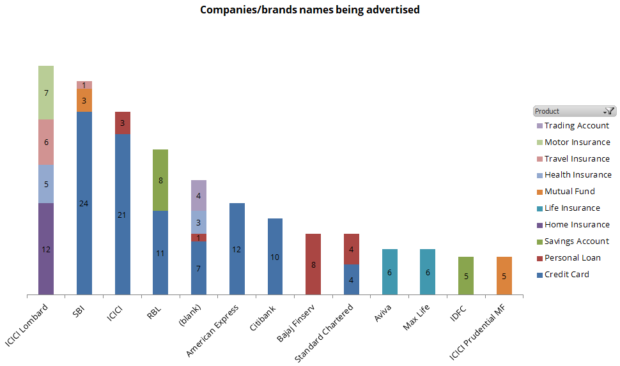

What the brands advertised:

[Note: long tails both of brands and products have been removed in the above graph to make it readable]

[Note: long tails both of brands and products have been removed in the above graph to make it readable]

Like I said, credit cards were the main culprits across brands/companies. ICICI Lombard is one exception, the team there seems to be divided between which product to give attention to and bombard their data base with emails on home, health, travel and motor insurance in equal measure. A few new entrants – RBL and IDFC – were pushing their savings account product as well. While Bajaj Finserv was pushing the personal loans.

The bait:

Now the subject line has a super critical role to play in email marketing. It has to grab attention; provoke, interest and encourage further opening and reading of the email body. And because such email open rates are abysmally low, they have to lead to and sometimes even deliver the brand’s benefit. In short, between the ‘from’ and the ’email header/subject’ the intended recipient should get a crystal clear idea about the brand and the benefit.

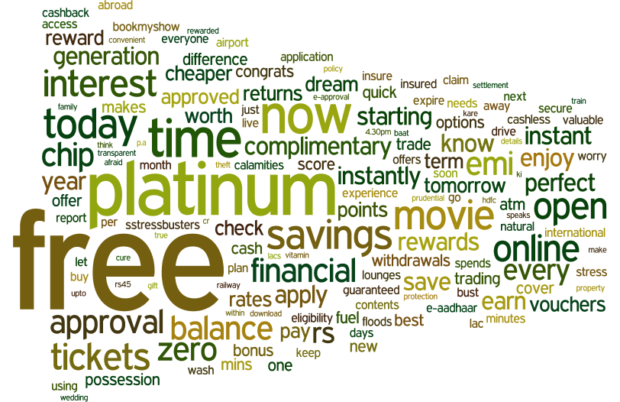

And this is what the subject lines shout out…

…the product and the brand. Which is such a huge waste. Removing both, we get the following…

…the product and the brand. Which is such a huge waste. Removing both, we get the following…

…now here is the problem.

The products and brands all seem to be primarily screaming, a) discounted – free, saving, cheap, save etc., and b) reward – complementary, reward, tickets, cashback, lounges, bonus, offer etc. Very few are on topics like a) convenience – instant, convenient, minutes, quick, cashless, access etc., or b) assurance – guaranteed, stress, enjoy, transparent etc., or c) expertise – expert, know, speaks etc., or d) variety – options etc.

The basic selling of almost all products on discounts and rewards is quite telling and seems to indicate one of many things in this space – heavy competition, current stage of category evolution (nascent?), undifferentiated benefits. Or it can also indicate that the marketing teams are still learning the ropes in this industry – don’t understand the consumers enough, don’t know how to differentiate a ‘brand’ or probably even how to craft good communication strategies.

This is quite sad because so much can be done in the financial space in terms of pure marketing. And as I write this, I can’t help but remember 3 case studies (positioning / insight mining / communication development) that I studied as a brand marketer – Master Card (Mastercard at 40 – Priceless, note: goes to page 13 for Priceless campaign; note:pdf file; adage’s branded content) and HSBC (World’s local brand. note: case study).