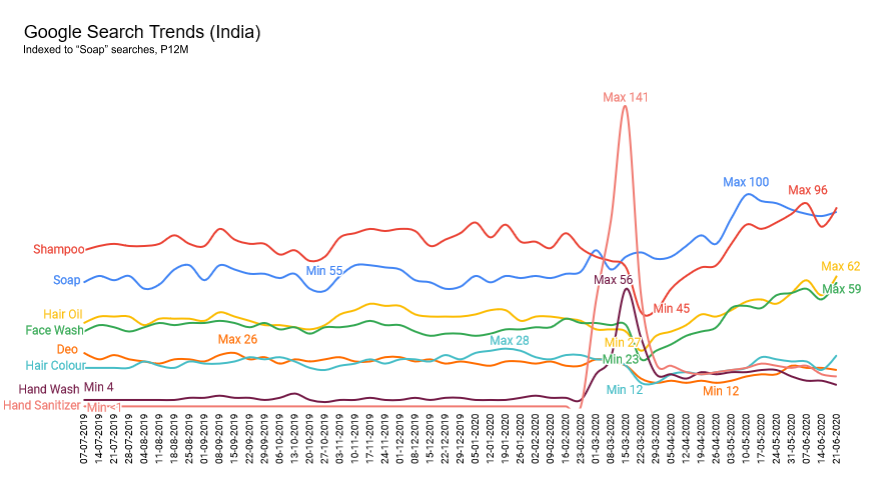

A month ago Google released a presentation identifying three search patterns they are seeing since the onset of COVID-19. They called it shock (quick rise and fall), step-change (Quick rise and showing signs of stabilization at elevated levels), and speed up (acceleration in growth rate of searches and showing signs of continued behavior for now).

However, I noticed an interesting trend yesterday. Generic search terms for personal care products are trending up and near 12 month peak for a number of categories.What is interesting is that the search trend has largely been flat since July-19 till March-20 showing those small seasonal or new campaign led peaks. While we see a similar trend at a worldwide level for Shampoo, we don’t see that for other terms.

I have a few hypothesis on why this is happening. The important assumption I make is that Google is the place where they research about products and Amazon is where they go once they decided about the product to purchase.

- With the COVID-19 pandemic, people are now a lot more cautious about the product/brand they are using.

- With increasing shelter at home/WFH requirements, people seek completely different benefits from these products.

- Both Soap and Shampoo exhibit a step change in searches somewhere in between May-June. There might be a benefit change requirement as this is a key seasonal change.

A little more digging and offline consumer research might very well give further clues to answering this puzzle. However, right now, there might actually be some interesting brand switching behaviours happening unbeknown to the marketers.

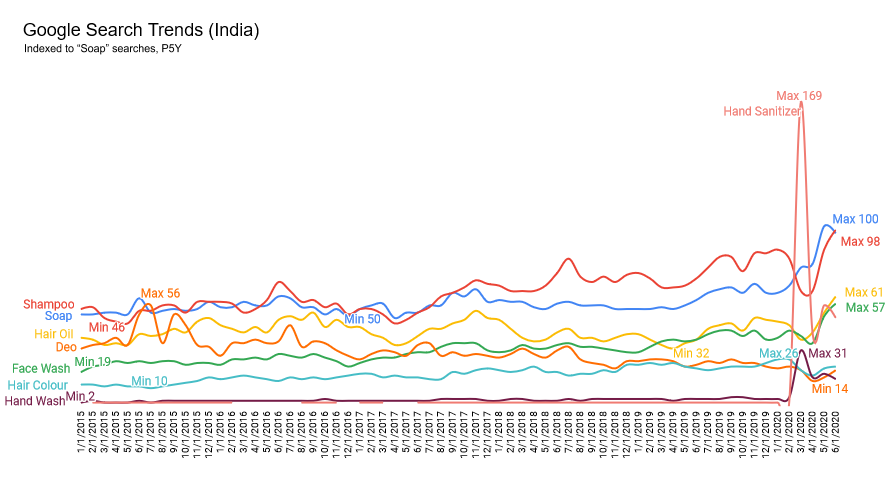

Here is a longer trend line which presents another interesting perspective.

A number of searches are near their all time high peaks. However, this might be also be because of more users on the internet as there has been a rapid increase in internet penetration over the last few years in India. While, Soaps, Hair Oils and Hand Washes have been near stagnant, Shampoo has seen 2 step changes between July-Nov’17 and Jul-Aug’19. Deodorant has been on a steady decline after peaking in June’15 and Hair colour has been very steadily growing. The reasons for this might warrant some digging though.

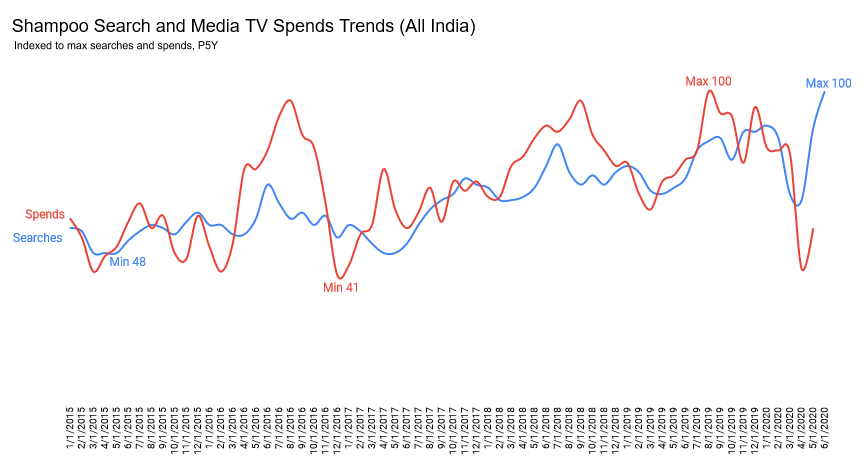

The graph below is a deeper look into the Shampoo trend where I’ve plotted media spends. Both of them are individually indexed to their maximum value.

What we do see are search peaks happening typically in the 4 summer months. This also broadly correlates to heavy media spends every year. However, when the step change in search happened in 2017, the media spends were pretty average. So, what led tot he step change in searches? This year was when MNCs retaliated to the Ayurvedic threat of Patanjali. HUL launched a 3 pronged attack with a new Ayush range as well as an Ayurvedic variant under Clinic Plus shampoo. It then went into overdrive starting to advertise Indulekha which it acquired in 2015. Then August end, 2 new innovations hit the market in Dove environmental defense shampoo and L’Oreal extraordinary clay shampoo. So there you have it, a new benefit segment suddenly moved the needle up on curiosity and probably usage. 2018, saw aggressive spends by Tresemme relaunch of Clinic All Clear as Pure Derm by HUL. Then there was the launch of 2-in-1 shampoo by P&G under H&S. There you have it, a clutter breaking premium benefit offering with adequate media support drove the interest even in a highly penetrated category.

What we do see are search peaks happening typically in the 4 summer months. This also broadly correlates to heavy media spends every year. However, when the step change in search happened in 2017, the media spends were pretty average. So, what led tot he step change in searches? This year was when MNCs retaliated to the Ayurvedic threat of Patanjali. HUL launched a 3 pronged attack with a new Ayush range as well as an Ayurvedic variant under Clinic Plus shampoo. It then went into overdrive starting to advertise Indulekha which it acquired in 2015. Then August end, 2 new innovations hit the market in Dove environmental defense shampoo and L’Oreal extraordinary clay shampoo. So there you have it, a new benefit segment suddenly moved the needle up on curiosity and probably usage. 2018, saw aggressive spends by Tresemme relaunch of Clinic All Clear as Pure Derm by HUL. Then there was the launch of 2-in-1 shampoo by P&G under H&S. There you have it, a clutter breaking premium benefit offering with adequate media support drove the interest even in a highly penetrated category.

This is exactly what happened in Deodorant category as well. 2015 saw the launch of Fogg Scent with heavy investments. Subsequent to this, there were a plethora of me toos from other brands. There was an innovation in 2017 with pocket deodorant launch but it was not a premium or online phenomena. The 2019 launch of Duo packs weren’t either adequately supported or the benefit wasn’t compelling or communicated in a proper way.